Bitcoin Price Volatility: On-Chain Data vs. Options Market Sentiment

Note: This post may contain affiliate links, and we may earn a commission (with No additional cost for you) if you make a purchase via our link. See our disclosure for more info. The crypto world is constantly changing. This content is for informational purposes only and not financial, legal, or professional advice So, please verify the info on the cryptocurrency provider’s websites.

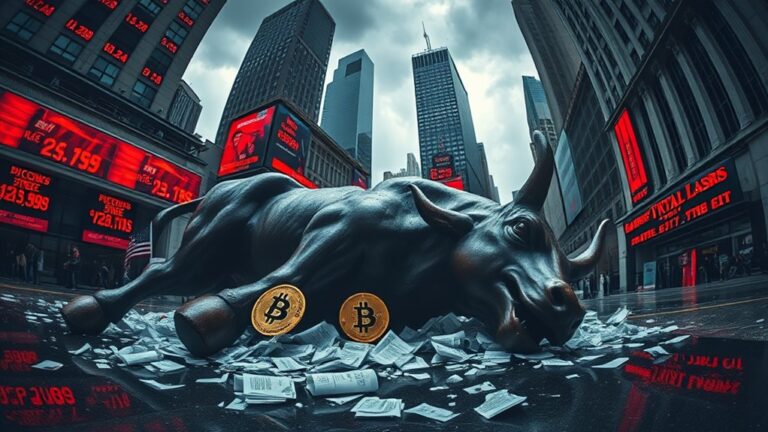

A divergence is brewing in the Bitcoin market. On-chain data, specifically the Realized Supply Density, indicates a high concentration of Bitcoin around the current price, suggesting that even small price movements could trigger significant volatility. This is because a large number of investors bought near the current price, making them sensitive to price changes. Glassnode, an analytics firm, highlights this concentration as increasing the likelihood of amplified reactions to price fluctuations. However, this assessment contrasts sharply with the sentiment in the Bitcoin options market. The At-The-Money Implied Volatility (ATM IV), which reflects traders' expectations of future volatility, has been steadily declining across various timeframes. This suggests that options traders are pricing in relatively low volatility, exhibiting a degree of complacency. Historically, this type of complacency has often preceded periods of increased volatility, creating a potential counter-trend signal. The discrepancy between on-chain data predicting higher volatility and the options market expecting lower volatility creates an interesting market dynamic. Currently, Bitcoin is trading around $108,800, up over 3.5% in the last week. This situation presents a fascinating scenario for market watchers, as the potential for significant price swings exists despite traders' apparent calmness. The coming days will be crucial in determining whether on-chain indicators or options market sentiment will prevail, ultimately shaping the direction of Bitcoin's price.

(Source: https://www.newsbtc.com/bitcoin-news/bitcoin-options-traders-expect-on-chain-chaos/)