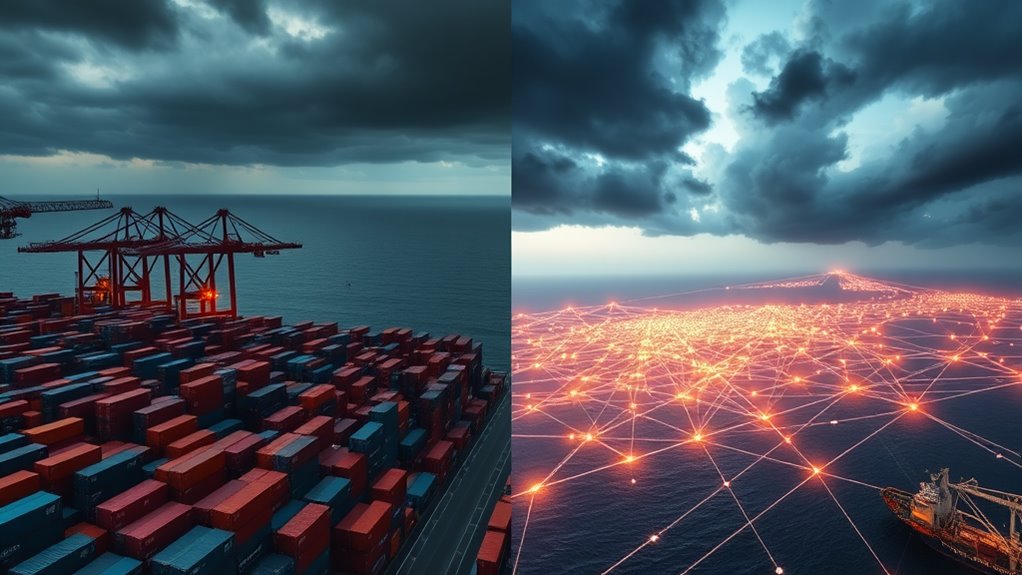

Global Trade Wars Threaten to Shatter Blockchain’s Borderless Promise

Note: This post may contain affiliate links, and we may earn a commission (with No additional cost for you) if you make a purchase via our link. See our disclosure for more info. The crypto world is constantly changing. This content is for informational purposes only and not financial, legal, or professional advice So, please verify the info on the cryptocurrency provider’s websites.

trade wars hinder blockchain potential">

trade wars hinder blockchain potential">As trade tensions spiral into full-blown economic warfare, blockchain technology and cryptocurrencies are getting caught in the crossfire. U.S. tariffs of 10% on most imports and a hefty 25% on Canadian and Mexican goods have triggered a global chain reaction. China didn't waste time hitting back with 34% retaliatory measures. Europe, Britain, and India are lining up their own counterpunches. So much for digital borderless utopia, right?

Market panic is everywhere. Shanghai stocks dropped 6%, while Hong Kong's Hang Seng plummeted 10%. Bitcoin, supposed savior from traditional market chaos, fell below $78,000 when things got rough. So much for being “digital gold.” Turns out crypto isn't immune to human fear after all.

Households are feeling the pain. The Tax Foundation estimates these tariffs cost each American family about $1,900 annually. That's vacation money. Or rent. Or food. Real consequences for real people.

Investors are scrambling for safety. Cash, gold, dollars. The usual suspects. But notably, crypto saw massive inflows too. People are hedging their bets. Traditional markets look shaky, and decentralized assets suddenly seem less crazy.

DeFi platforms might actually benefit from this mess. When centralized systems falter, alternatives look attractive. ML Tech analysts believe cryptocurrencies will eventually break their correlation with stock markets. Maybe. We'll see.

The economic outlook is bleak. Recession risks are climbing. U.S. consumer prices are already up. Asian markets took historic losses. And now there's talk of a U.S. government shutdown? Perfect timing.

Cross-border transactions using cryptocurrency could theoretically bypass trade barriers. Smart contracts might reduce friction. But that's long-term thinking. Right now, crypto is getting dragged down with everything else.

The promise of blockchain was a world without economic borders. A financial system immune to political tantrums. That vision is being tested. Hard. When tariffs start hitting 200% on wine, as the EU threatens, even digital assets feel the pressure. Global trade wars don't respect technology—no matter how revolutionary. The current situation evokes memories of Black Monday 1987, with markets already down 17% from February highs and analysts warning of a potential bloodbath. Trump's threat of 200% tariffs on European alcoholic beverages dramatically escalates tensions and compounds market nervousness across all sectors.