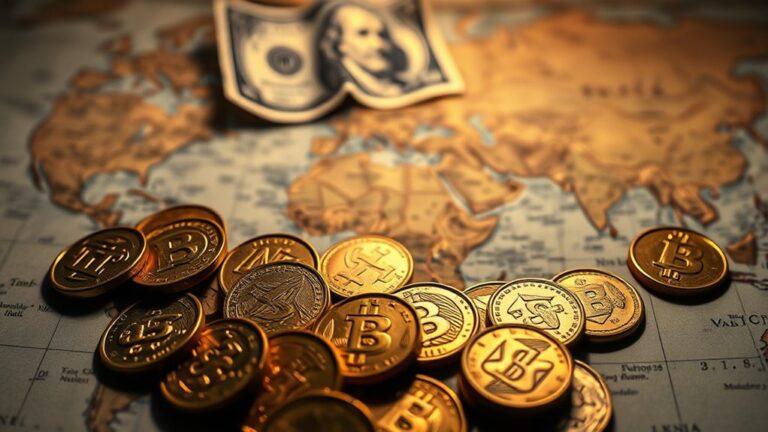

Gold-Backed Tokens Surge Past $1B as Investors Flee Banking Uncertainty

Note: This post may contain affiliate links, and we may earn a commission (with No additional cost for you) if you make a purchase via our link. See our disclosure for more info. The crypto world is constantly changing. This content is for informational purposes only and not financial, legal, or professional advice So, please verify the info on the cryptocurrency provider’s websites.

While the broader crypto market flounders in its usual volatility, gold-backed tokens have smashed through the billion-dollar ceiling. Market cap for these glittering digital assets has surged to nearly $2 billion, jumping 5.7% in just 24 hours. Investors aren't messing around anymore – they want safety, and they want it backed by something that's been valuable since, well, forever.

The numbers don't lie. March 2025 saw the tokenized gold market hit $1.4 billion, with trading volume exceeding $1.6 billion – the highest in a year. Now in April, weekly volume has topped $1 billion for the first time since 2023. That's a staggering 1,000% increase. Not too shabby for something that's fundamentally just digital receipts for metal.

Tether Gold (XAUT) is leading the pack with a $749 million market cap. Meanwhile, Paxos Gold (PAXG) trading volume is up over 900%. But the real showstopper? Kinesis Gold (KAU) with its mind-boggling 83,000% volume increase. Yes, you read that right. Eighty-three thousand percent.

What's driving this gold rush? Trump's import tariffs, for one. Global trade war fears have investors running for cover. Physical gold reached an all-time high of over $3,100 per ounce on March 31. Then there's that little banking crisis involving SVB, Silvergate, and Signature that scared the pants off everyone. With physical gold breaking $3,000 per ounce, the digital version looks pretty appealing.

Investors aren't gambling with uncertainty anymore – they're betting on the oldest safe haven in human history, now in digital form.

The contrast with regular crypto is stark. While tokenized gold saw 21% market cap growth, stablecoins managed just 8%. Still, the entire stablecoin sector has ballooned to $231 billion, with Tether's USDT accounting for $144 billion despite seeing its market share drop to 62%. Much like how Netflix's recommendation system is worth billions in retention, these gold-backed tokens are proving their value by keeping investors from fleeing the digital asset space entirely.

Real World Asset (RWA) tokenization is expanding beyond gold to include real estate and art. Even newcomer USDtb from Ethena has crashed the party, entering the top 8 stablecoins with $1 billion in assets.

The message is clear: in uncertain times, investors want something solid backing their digital assets. And nothing says “solid” quite like gold. Even when it's just ones and zeros.